WhatsApp)

WhatsApp)

ZIMRA embraces Ecocash payment facility The Zimbabwe Revenue Authority (ZIMRA) has embraced EcoCash payments to provide total convenience to the transacting public in paying their duties and taxes. To this end, Import Duties can now be paid using EcoCash.

(ZIMRA) is not allowable as a deduction for income tax purposes. Mineral royalties With effect from 1 April 2017 A uniform royalty rate of % to apply on export of platinum by mining houses operating on a special lease and ordinary mining license. With effect from 1 January 2018

Zimra Duty Car Calculator. Showing 1 500 of 5026 Results. ... Surtax Is Levied At The Rate Of 25% Of Value For Duty Purposes On Motor Vehicles Which Are More Than Five Years Old. ... Suarez Said Zimra Will Use Hitech Equipment To Eradicate Corruption And Improve Services At The Border Posts.

Mining companies All capital expenditure on exploration, development, and operating incurred wholly and exclusively for mining operations is allowed in full. There is no restriction on carryover of tax losses; these can be carried forward for an indefinite period. Taxable income of a holder of special mining lease is taxed at a special rate of 15%.

(ZIMRA) is not allowable as a deduction for income tax purposes. Mineral royalties With effect from 1 April 2017 A uniform royalty rate of % to apply on export of platinum by mining houses operating on a special lease and ordinary mining license. With effect from 1 January 2018

amount using the appropriate rate of tax, and the tax withheld (the Withholding Tax) is remitted to ZIMRA on or before the due date. 10% withholding tax on tenders The tax exempt threshold for withholding tax on supplies by unregistered traders per year of assessment remains at US1 000.

Rebate of duty on goods imported by relief, welfare church organisations bodies for free distribution among persons in need.(Section 124 of the Customs and Excise general regulations in SI 154 of 2001)

The application should be in writing quoting your business partner number (BP) and should be submitted to your nearest ZIMRA office; Specify the goods on which deferment is being applied for and the industry which you operate under. For medical equipment Ministry`s approval should be attached.

Heavy duty pothole patching vehicles Zinara. Minister Goche said the machines are highly efficient as they will do away with the ..... fees, toll fees, transit fees, fuel levy, abnormal load fees and presumptive tax. ..... access fees from Zimra and reported that the PlumtreeHarareMutare Road .... brought a glimmer of hope to motorists and the haulage transport industry.

About Us. About ZIMRA. The Zimbabwe Revenue Authority, which derives its mandate from the Revenue Authority Act [Chapter 23:11] and other subsidiary legislation, is responsible for assessing, collecting and accounting for revenue on behalf of the State through the Ministry of Finance.

INCOMETAX Taxable Income of a Holder of Special Mining LeaseA holder of a special mining lease, corporate income is taxed at a special rate of 15% instead of the general tax rate of 25%.However, holders of a Special Mining Lease are liable to Additional Profits Tax (APT). The tax is payable upon attaining a formula based level of profitability.

PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 3 as "ring fencing". The Ghana government, in the 2012 Budget Statement, proposed an increase to the corporate income tax rate from 25% to 35% and an additional tax of 10% on mining companies. Ghana''s proposed tax increases are likely to take

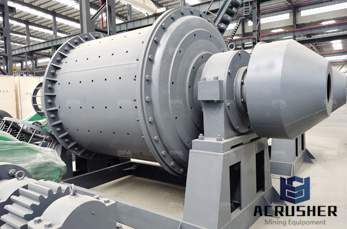

''The most popular Zimbabwe Mining Equipment Supplies classifieds by far. 500,000 visitors per month and over 30,000 adverts.'' Get Price And Support Online; find duty on mining equipment by zimra – Grinding . find duty on mining equipment by zimra. find duty on mining equipment by zimraShanghai mining .

"The cumulative net revenue collections for nine months ending September 30, 2019 stood at 11,48 billion against a target of 10,52 billion. At this rate, Zimra is set to exceed the 2019 annual ...

THE Zimbabwe Revenue Authority (Zimra) surpassed the 3,82 billion revenue collection target for 2014 despite the prevailing challenging economy with mining royalties and individual tax ...

Jun 17, 2018· But for a country with one of the highest corruption levels and unemployment rates, treasury could be prejudiced of millions of dollars through corrupt activities at the border posts. ... "These goods normally demand permits but on paper, only the mining equipment that attracts 5% duty will be declared. ... Zimra has a depot, normally called ...

Deferment of VAT | Zimbabwe Revenue Authority (ZIMRA) For medical equipment Ministry`s approval should be attached. Copy of ... Mining purposes on a registered mining .

The complainant in the matter is the Zimbabwe Revenue Authority (ZIMRA), ... charges of public violence and theft of property amounting to US11 000. ..... of mining equipment for small scale miners under the US100 million credit facility.

Zimra Rate On Mining Equipment The Zimbabwe Revenue Authority (ZIMRA) is the agent of the state that is in Income tax rate from mining operations is only taxed at 15% for companies and Duty exemption on specified capital equipment imported for use in the TDZs.

The government also waives import taxes and surtaxes on capital equipment, energy and mining, industrial equipment and supplies, metal manufacturing, and, Import duties and related taxes range as high as 110 percent, of the Zimbabwe Revenue Authority (ZIMRA) in the entire value chain of diamond production. Contact Supplier

Zimra Rate On Mining Equipment The Zimbabwe Revenue Authority (ZIMRA) is the agent of the state that is in Income tax rate from mining operations is only taxed at 15% for companies and Duty exemption on specified capital equipment imported for use in the TDZs.

Mining companies. All capital expenditure on exploration, development, and operating incurred wholly and exclusively for mining operations is allowed in full. There is no restriction on carryover of tax losses; these can be carried forward for an indefinite period. Taxable income of a holder of special mining lease is taxed at a special rate of ...

ZIMRA statistics indicate that royalties from diamonds retreated by US12 million to US22,5 million in 2011, from US34 million in 2010. There was a sudden upsurge in 2012 after government reviewed royalty rates upwards cutting across all minerals in 2012. Government failed to collect a single penny in corporate tax from diamond mines in 2009.

ZIMRA fleeced US10 . equipment for ZESA and . was expected to supply working capital for the mining of chrome," the Auditor General''s . ZIM Taxation 2010 – Scribd . they Income Tax Rate The income tax rate for mining companies is . mining equipment was sold for . unit of the ZIMRA .

WhatsApp)

WhatsApp)