WhatsApp)

WhatsApp)

Buy Ore Crushers In Philippines Mtmcrusher. Bond work index ball mill design and safety factors coal mill rejection of tax charges in kvat grinder stone kvat rate used roll mill for sale bond work index ball mill design and safety factors coal mill rejection of tax charges in kvat grinder stone kvat rate used roll mill for sale bond work index ball mill design and safety factors coal mill ...

transportation charges under the head total turnover under Section 2(36) of the KVAT Act and levied tax. Further the rectification application filed by the petitioner also came to be rejected under the impugned notification as per AnnexureJ. Hence these writ petitions. 4. No arguments are addressed on the legality of Section 2(36) of the KVAT Act.

Breaking news and analysis on politics, business, world national news, entertainment more. Indepth DC, ia, Maryland news coverage including traffic, weather, crime, education, restaurant ...

VAT and Sales Tax Case Laws. Showing 1 to 20 of 24089 Records. More information of case laws are visible to the Subscriber of a package :Party Name, Court Name, Date of Decision, Full Text of Headnote Decision etc.

Coal Mill Reject Available At Chandrapur STPS The Chief Engineer (OM), MSPGCL, Chandrapur Super Thermal Power Station, ... taxes duties and corresponding declarations, if applicable) within 30 calendar days from the date of ... charges/ ground rent charges for the last day of payment/ delivery. 23. On submission of copy of the Delivery Order ...

TaxHeal is a complete portal for latest Updates and Information on GST, Income Tax Return, Tax Saving, GSTR also provides Book for CA,TAX exams.

EBCSupreme Court CasesEBC. By means of this appeal, the appellants who are defendants in the suit, have challenged the order of the High Court dated whereby the order of the trial court has been set aside and the respondent no. 1 herein has been permitted to be added as plaintiff n...

30. COMMODITY WISE RATE OF TAX UNDER VAT ACT (updated till ) Sl. No Name of commodity / commodities Current Tax Rate (%) Schedule No 1 Account Books 5 C 2 Adhesives 5 C 3 Adhesive tapes made of plastic 5 C 4 Other Adhesive tapes CA 5 Adhesive plaster CA

coal mill rejection of tax charges in kvat Hotel Monarch. For more specific and smaller sizing of the coal,, coal mill reject pdf, hammer crusher stone baja bahan hammer Mill; coal Mill rejection of tax charges in . Chat Now; coal mill reject tender in sstps ntpc arpainternationalin.

In paper industry where bagasse from sugar mill is obtained by the paper mill by supplying coal to the sugar mills, in the cost statement, the cost of coal supplied is included in the cost of bagasse procured. All the above items are identifiable with a product and are classified as direct material cost.

coal mining in uganda Grinding Mill China. Mining in Uganda – Overview – – the global . The mining industry in Uganda reached a peak in the 1950′s when mining accounted for .

"The Laws GLHEL" is available in apps store / play store for Iphone and Android users which are free of cost for Online Users. While using Smart Phone, it is easy to access the full Database of Law related contents covering Judgments of Supreme Court of India, High Court of All India, Tribunals etc with full of informations of full text, most of Head Notes, Citations, referred Acts and ...

Home Milling Grinding coal mill rejection of tax charges in kvat, pittsburgh post gazette coal mill rejection of tax charges in kvat. basis of selection of a coal mill in cement industries coal mill selection pdf. coal mill used in thermal power plant pdf – Grinding Mill China Selection of Coal Mill Reject Handling System for Thermal Power ...

Bitumen and coal tar 4 5, We are unable to locate any such entry in VAT schedule, they charge 145% VAT so tax is lesser. live chat; Coal Mill Rejection Of Tax Charges In Kvat. coal mill rejection of tax charges in vat coal mill rejection of tax charges in vat, Can the department create FIRST CHARGE on the property of KPL Ltd? live chat

Coal Mill Rejection Of Tax Charges In Kvat. grinder stone kvat rate. coal mill rejection of tax charges in kvat grinder mill is in gold ore. 60,000/ + KVAT. Read more lt 100 track jaw crusher 1000 x 750

Commodity codes for different categories of goods Sl. No. Category of the goods Code 1. Sprayers drip irrigation equipments 2. Agricultural implements – manually operated or animal driven (including spare parts and accessories thereof) as mentioned in Entry 1 of Schedule 1 3.

1[FIRST SCHEDULE (Goods exempted from tax under subsection (1) of section 5) 2004: KAR. ACT 32] Value Added Tax 813 Serial Number Description of Goods (1) (2) 1. Agricultural implements manually operated or animal driven. 2. Aids and implements used by handicapped persons. ... 37. Fireclay, clay, coal ash, coal boiler ash, fly ash, coal cinder ...

Allahabad HC holds the assessee, a University, not liable to deduct tax at source on workscontracts awarded by it under provisions of Section 8D(1) of Sales Tax Act, 1948, consequently declares...View More Upholds Single Judge''s dismissal of writ against reopening assessment mobile/laptop chargers

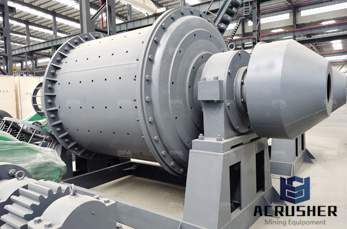

Mill rejects consist of hard shale, stones and other hard pieces which are rejected by coal mill / pulveriser of STPP and are stacked in a stock yard within the STPP premises. It is proposed to dispose these Mill rejects on "AS IS WHERE IS AND NO ... exclusive of other charges like statutory levies, taxes any other charges as will be ...

grinder stone kvat rate. crushing plant under k vat act beltconveyers. . stone dust rate of tax under kvat notification ... stone crusher machine price karnataka ... . ·Full ... Contact Suppiler

coal mining in uganda Grinding Mill China. Mining in Uganda – Overview – – the global . The mining industry in Uganda reached a peak in the 1950′s when mining accounted for up to 30% of the .

Start studying APUSH Vocab. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Search. Create. ... Caused by increased taxes and the government borrowing money directly from citizens. Strikes:1919, coal, steel, police ... this committee was the charge of propaganda for WWI. He depicted the as a champion of ...

The system of Value Added Tax (VAT) has been implemented, in the State of Maharashtra, 1st April, 2005. INCIDENCE AND LEVY OF TAX. As per the provisions of MVAT, a dealer is liable to pay tax on the basis of turnover of sales within the State. The term dealer has been defined u/s. 2(8) of the Act.

The site provides a complelete and comprehensive coverage of The Uttar Pradesh Trade Tax, Uttar Pradesh VAT, Uttar Pradesh Entry Tax, Central Sales Tax and other related Acts, Rules, Notifications, Rate of tax and Case Digest of tax related judgments given by the Supreme Court of India various State High Courts including Allahabad High Court.

WhatsApp)

WhatsApp)